Semlab event detection is used to very quickly screen very large amounts of data on a pre defined set of subjects.

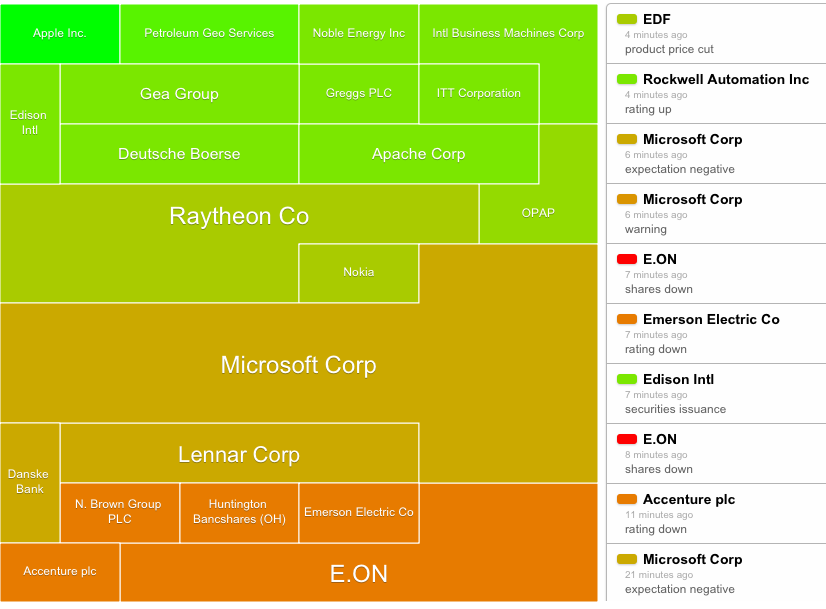

In this demo, financial news originating from a large number of twitter accounts is continuously monitored. The system searches for messages that may influence the market value of the most traded shares. The expected impact of such a message is shown in green (positive) or red (negative) color.

Start the demo, to access the application containing current set of detected events, or click here for a visual representation of the news.

Good luck!

Background

The language model used in this demo is rule-based and built from our semantic financial news ontology. The reason why no neural network based language models were used for this application is simply that they are too slow for the intended application. Processing speed is crucial for processing financial reporting. With our implementation we are able to translate such news items into structured “news events” within milliseconds. These events are fast enough to effectively be used to trigger follow-up actions, for example in “automated trading” implementations.

Practical applications

This technology can be applied wherever there is an “overload” of information and a clear idea about a set of events of interest. Other applications besides the showcased demo in the field of financial market sentiment, could be about monitoring the media about product experiences, processing computer access security logs to look for intrusions or filtering twitter for discrimination.